Phone: 725-910-8591

Monday-Friday 9:00am- 4:00pm

Saturday & Sunday By Appointment only

Frequently Asked Questions

Frequently Asked Questions

Most common asked Medicare Questions!

Who is eligible for Medicare?

You are generally eligible for Medicare if you are a U.S. citizen or a legal resident who has lived in the U.S. for at least five continuous years, and you meet one of the following criteria:

You are age 65 or older.

You are under age 65 but have a qualifying disability and have received Social Security Disability Insurance (SSDI) benefits for 24 months.

You have End-Stage Renal Disease (ESRD), which is permanent kidney failure requiring dialysis or a kidney transplant.

You have Amyotrophic Lateral Sclerosis (ALS).

What is Medicare Part A?

Medicare Part A is your hospital insurance. It helps cover the costs of inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services.

Most people do not pay a monthly premium for Part A because they or their spouse paid Medicare taxes while working for at least 10 years. Because of this, there is typically no penalty for late enrollment. However, if you are required to pay a premium for Part A and you don’t sign up when you’re first eligible, your monthly premium may increase by 10% for twice the number of years you didn't have coverage.

What is Medicare Part B?

Medicare Part B is your medical insurance. It covers doctor’s services, outpatient care, medical supplies, and preventive services like flu shots.

The Deductible: For those with Original Medicare, there is an annual deductible you must pay each year before your coverage begins. In 2025, the Part B deductible is $257.00. After you meet this deductible, Original Medicare typically pays 80% of the Medicare-approved amount for services, and you are responsible for the remaining 20%.

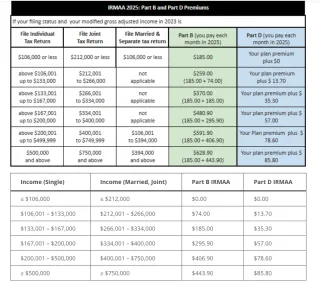

The Cost: The standard monthly premium for Medicare Part B in 2025 is $185.00 for those whose income is under a certain threshold. If your income exceeds that amount, you will pay a higher premium.

The Penalty: If you don’t sign up for Part B when you are first eligible and don't have other creditable coverage (like from an employer), you may have to pay a 10% premium penalty for each full 12-month period you were eligible but didn’t enroll. This penalty is added to your monthly Part B premium for the rest of your life.

Getting Help with Costs: If you have limited income and resources, you may qualify for a program like Medicaid, which can help pay your monthly Part B premium. I can help you determine if you are eligible for assistance programs.

What is Medicare Part C, (Medicare Advantage)?

Medicare Part C, also known as Medicare Advantage, is a different way to get your Medicare benefits. These plans are offered by private insurance companies approved by Medicare. Medicare Advantage plans must cover everything Original Medicare (Parts A and B) covers, and they often include extra benefits like dental, vision, hearing, and prescription drug coverage (Part D).

What is Medicare Part D (Prescription Drug)?

Medicare Part D is your prescription drug coverage. This is a separate plan you can enroll in to help cover the cost of your prescription medications. It is offered by private insurance companies that are approved by Medicare.

The Penalty: If you go 63 days or more in a row without a Medicare Part D plan or other creditable prescription drug coverage, you may have to pay a late enrollment penalty. The penalty is calculated based on the number of months you went without coverage and is added to your Part D premium for the rest of your life.

When can I Enroll In Medicare?

Understanding Medicare enrollment periods is crucial to avoid late penalties and gaps in coverage. Here’s a simple breakdown of the process.

The "When" to Enroll

There are three main times you can enroll:

Initial Enrollment Period (IEP): This is your first chance to sign up for Medicare. It's a 7-month window that begins 3 months before your 65th birthday month, includes your birthday month, and ends 3 months after your birthday month.

Tip: If you are already receiving Social Security benefits, you will be automatically enrolled in Parts A and B. Your Medicare card will arrive in the mail about 3 months before your 65th birthday.

General Enrollment Period (GEP): If you miss your IEP and don't qualify for a Special Enrollment Period, you can sign up for Part A and/or Part B between January 1 and March 31 each year. Your coverage will begin the month after you sign up, and you may have to pay a late enrollment penalty.

Special Enrollment Period (SEP): You may be eligible for an SEP if you or your spouse are still working past age 65 and are covered by a group health plan. You have an 8-month period to enroll after your employment or group health coverage ends, whichever comes first. This allows you to avoid the late enrollment penalty.

The "How" to Enroll

Online: The easiest and fastest way to enroll is online through the Social Security Administration's website. You can apply for just Medicare even if you're not ready to apply for retirement benefits.

By Phone: You can call Social Security's national toll-free number.

In Person: You can visit your local Social Security office. It's recommended to call ahead to make an appointment.

Helpful Resources:

Social Security Administration (SSA): To enroll in Medicare, visit www.ssa.gov or call 1-800-772-1213.

Medicare.gov: The official U.S. government site for Medicare. You can get comprehensive information and tools here. Visit www.medicare.gov.

Need Help with Enrollment? Navigating this process can be complicated. As your trusted broker, I can help you understand your options, verify your eligibility, and walk you through the enrollment process step-by-step at no cost to you.

How Do I Enroll into Medicare?

How do I enroll in Medicare?

Enrolling in Medicare is a crucial step, and the process can depend on your individual situation. Here is a breakdown of the key steps and enrollment periods.

Automatic Enrollment-

You will be automatically enrolled in Original Medicare (Part A and Part B) if you are:

Already receiving benefits from Social Security or the Railroad Retirement Board (RRB) at least four months before you turn 65.

Under age 65 and have been receiving Social Security Disability Insurance (SSDI) or RRB disability benefits for 24 months.

Diagnosed with Amyotrophic Lateral Sclerosis (ALS) and receiving SSDI.

If you are automatically enrolled, your Medicare card will be mailed to you about three months before your 65th birthday or your 25th month of disability.

Manual Enrollment-

If you are not automatically enrolled, you will need to sign up yourself. The most common way to do this is through the Social Security Administration.

Online: The easiest way is to apply online at the Social Security website (www.ssa.gov/medicare).

Phone: You can call Social Security at 1-800-772-1213 (TTY 1-800-325-0778).

In-Person: You can visit your local Social Security office.

Key Enrollment Periods-

Understanding the enrollment periods is critical to avoid potential late enrollment penalties.

Initial Enrollment Period (IEP): This is a 7-month window around your 65th birthday. It includes the three months before your birthday month, your birthday month, and the three months after. This is when most people should sign up for Part A and Part B.

General Enrollment Period (GEP): If you miss your IEP and are not eligible for a Special Enrollment Period, you can sign up for Part B (and premium Part A) during the GEP, which runs from January 1 to March 31 each year. Your coverage will not begin until July 1, and you may face late enrollment penalties.

Special Enrollment Period (SEP): You may qualify for a Special Enrollment Period if you or your spouse are still working and have employer-sponsored group health coverage. This allows you to delay signing up for Medicare Part B without penalty.

Don't Forget to Check for Additional Help-

Navigating the cost of Medicare can be challenging, but there are programs available to help. When you are considering your options, you should also check to see if you are eligible for Low-Income Subsidy (LIS), also known as "Extra Help," and Medicaid.

LIS (Extra Help): This federal program helps pay for the costs of Medicare Part D prescription drug coverage, including premiums, deductibles, and co-payments.

Medicaid: This joint federal and state program can help with Medicare premiums, deductibles, and co-insurance. Many people who qualify for both Medicare and Medicaid (often called "dual-eligibles") can save a significant amount on their healthcare costs.

Helpful Resources-

Medicare.gov: The official government site for all things Medicare. It has a wealth of information, a plan finder tool, and resources to help you.

Social Security Administration (SSA): The SSA manages Medicare enrollment and can help you with eligibility questions.

State Health Insurance Assistance Programs (SHIP): These programs offer free, unbiased counseling on Medicare topics. You can find your local SHIP office by searching on the Medicare.gov website.

The Medicare enrollment process can feel overwhelming, but you don't have to go through it alone. I am here to help you navigate this process, understand your options, and ensure you are enrolled in the right plan for your needs. We can also review your financial situation to see if you qualify for any of these valuable assistance programs.

What is a Medigap plan or Medicare Supplement?

A Medigap plan, also known as a Medicare Supplement plan, is a type of health insurance policy sold by private companies to help cover the "gaps" in Original Medicare (Part A and Part B).

Original Medicare pays for most but not all of your health care services and supplies. The "gaps" you would otherwise be responsible for include:

Copayments

Coinsurance

Deductibles

A Medigap policy works by paying for these out-of-pocket costs after Original Medicare has paid its share. It's a way to get more predictable and comprehensive coverage, as it helps to limit your out-of-pocket expenses for services that are already covered by Medicare.

How Original Medicare Costs Work

To understand the value of a Medigap plan, it helps to know what Original Medicare covers and what you are responsible for:

Medicare Part A (Hospital Insurance):

Deductible: For 2025, the Part A deductible is $1,676 per benefit period. A "benefit period" starts the day you're admitted as an inpatient in a hospital and ends when you haven't received any inpatient hospital care or skilled nursing facility care for 60 days in a row. You could have more than one benefit period in a year.

Coinsurance: After you meet your deductible, you pay $0 for the first 60 days of an inpatient stay. For days 61-90, you pay $419 per day, and for days 91 and beyond, you pay $838 per day (using your lifetime reserve days).

Medicare Part B (Medical Insurance):

Deductible: For 2025, the annual Part B deductible is $257. You must pay this amount before Medicare starts to pay its share.

Coinsurance: After your deductible is met, you are generally responsible for 20% of the Medicare-approved amount for most doctor's services, outpatient therapy, and durable medical equipment. Medicare pays the remaining 80%.

This is where a Medigap plan comes in, as it can help cover those deductibles and the 20% coinsurance, leaving you with very few or no out-of-pocket costs for Medicare-approved services.

How does Original Medicare work?

How Original Medicare Costs Work

To understand the value of a Medigap plan, it helps to know what Original Medicare covers and what you are responsible for:

Medicare Part A (Hospital Insurance):

Deductible: For 2025, the Part A deductible is $1,676 per benefit period. A "benefit period" starts the day you're admitted as an inpatient in a hospital and ends when you haven't received any inpatient hospital care or skilled nursing facility care for 60 days in a row. You could have more than one benefit period in a year.

Coinsurance: After you meet your deductible, you pay $0 for the first 60 days of an inpatient stay. For days 61-90, you pay $419 per day, and for days 91 and beyond, you pay $838 per day (using your lifetime reserve days).

Medicare Part B (Medical Insurance):

Deductible: For 2025, the annual Part B deductible is $257. You must pay this amount before Medicare starts to pay its share.

Coinsurance: After your deductible is met, you are generally responsible for 20% of the Medicare-approved amount for most doctor's services, outpatient therapy, and durable medical equipment. Medicare pays the remaining 80%.

This is where a Medigap plan comes in, as it can help cover those deductibles and the 20% coinsurance, leaving you with very few or no out-of-pocket costs for Medicare-approved services.

What is the Medigap "Birthday Rule?

An important factor for those who already have a Medigap policy is the "Birthday Rule." This is a state-specific law that allows you to change your Medigap plan around your birthday each year without having to go through medical underwriting.

What it does: It gives you a special window (typically 30-60 days around your birthday) to switch to another Medigap plan of equal or lesser benefits.

Why it's important: Without this rule, you would typically have to answer health questions, and an insurance company could deny you coverage or charge you a higher premium based on pre-existing health conditions. The Birthday Rule allows you to shop for a more competitive premium on the same or a similar plan without fear of being denied due to your health.

Who it applies to: This rule is only available in certain states, so it's crucial to check if your state has this rule and understand the specific window and rules for that state.

It's important to understand the different types of Medigap plans and how they align with your health needs and financial situation. I can help you navigate the different plans and compare them side-by-side to find one that provides the best coverage for your specific needs, all while fitting within your budget. Feel free to reach out to discuss your situation and explore the options available to you.

Answers to your questions about individual, family, and private health plans.

What is the Affordable Care Act (ACA) and the Health Insurance Marketplace?

The Affordable Care Act (ACA), also known as "Obamacare," is a comprehensive healthcare reform law enacted in 2010. It created the Health Insurance Marketplace as an online platform where individuals and families can shop for and enroll in health insurance plans. The Marketplace is designed to make health coverage more accessible and affordable, especially for those who do not have access to employer-sponsored insurance. All plans sold on the Marketplace must cover essential health benefits, such as emergency services, hospitalization, prescription drugs, and mental health services.

Understanding Plan Networks: HMOs vs. PPOs

When choosing a health insurance plan, you'll often see two main types: HMOs and PPOs. The key difference lies in flexibility and cost.

HMO (Health Maintenance Organization): An HMO plan typically requires you to choose a Primary Care Provider (PCP) from the plan’s network. Your PCP manages all of your care and must provide a referral for you to see a specialist (like a dermatologist or cardiologist). If you go outside of the HMO's network for care, the plan generally will not cover the cost, except in a true emergency. These plans usually have lower monthly premiums.

PPO (Preferred Provider Organization): A PPO plan gives you more flexibility. You are not required to choose a PCP and you can see a specialist without a referral. While you will save money by staying within the plan’s network of "preferred providers," you have the option to see out-of-network doctors for an additional cost. PPO plans typically have higher monthly premiums than HMOs.

In Nevada, most health insurance plans are structured as HMOs (Health Maintenance Organizations), which require you to choose a Primary Care Physician (PCP). Your PCP will then manage and coordinate your care.

However, I also have a few private carrier options for PPO (Preferred Provider Organization) plans. These plans provide you with the flexibility to see doctors outside of your home state, giving you greater freedom and choice in your healthcare.

Most plans in Nevada are HMO'S and require the choice of a Primary care Physisan, I do have a few Privatre carrier options for PPOs to give you the flexablity to see drs outside of your Home state.

What is a Premium, Deductible, Co-payment, and Co-insurance?

These are the most common terms you'll encounter when managing your health insurance costs.

Premium: This is the fixed amount you pay every month to have health insurance coverage, regardless of whether you use any medical services.

Deductible: This is the amount you must pay out-of-pocket for covered medical services before your insurance company begins to pay. For example, if your deductible is $2,000, you will pay the first $2,000 of your covered medical expenses.

Co-payment (Co-pay): This is a fixed amount you pay for a specific service after your deductible has been met.For example, you might have a $25 co-pay for a doctor’s office visit or a $10 co-pay for a prescription.

Co-insurance: This is your share of the cost for a covered service, calculated as a percentage. After you have met your deductible, your insurance plan will pay its share and you will pay your share (the co-insurance). For example, if your plan's co-insurance is 20%, you would pay 20% of the cost for a service and your plan would pay the remaining 80%.

What is a Short-Term Medical Plan?

Short-term medical plans are health insurance policies that provide temporary coverage for a limited period, typically ranging from a few months up to a year. They are not considered "major medical" plans and are not required to follow the same rules as plans available on the Health Insurance Marketplace.

When are Short-Term Plans a Good Fit?

Short-term plans can be a useful solution if you are:

Between jobs or waiting for new employer-sponsored coverage to begin.

A recent college graduate no longer covered by your parents' plan.

Waiting for the next Open Enrollment Period to purchase a long-term plan.

An early retiree who is not yet eligible for Medicare.

Key Differences from Comprehensive Plans

It is crucial to understand that short-term plans are not a substitute for comprehensive, long-term health insurance. They have significant limitations, including:

No coverage for pre-existing conditions: Short-term plans are medically underwritten, which means they can deny coverage or refuse to pay for medical issues you have been diagnosed with or treated for in the past.

Limited benefits: They are not required to cover the "10 Essential Health Benefits" of the Affordable Care Act (ACA), which can include maternity care, mental health services, prescription drugs, and preventive care like annual physicals.

Less financial protection: While premiums are often lower, short-term plans can have much higher deductibles and a lower limit on how much they will pay, leaving you exposed to significant out-of-pocket costs in a serious medical event.

A Note on Nevada Regulations

In Nevada, short-term health plans have specific rules on how long they can last. As of late 2024, federal regulations limit new plans to a maximum of four months, including any renewals. This is important to consider as you plan your coverage.

Answers to your questions about Hospital Indemnity, Final Expense and Life Insurance

What is the Different Types of Life Insurance?

Choosing the right life insurance plan is a critical decision that depends on your financial goals, health, and what you want to protect. Here is a breakdown of some of the most common types of life insurance.

Term Life Insurance

Term life insurance is the most straightforward and often the most affordable type of life insurance. It provides coverage for a specific period of time, or "term," such as 10, 20, or 30 years.

How it works: You pay a fixed premium for the duration of the term. If you pass away during that term, your beneficiaries receive the death benefit. If you outlive the term, the policy expires, and there is no payout or return of premiums.

Best for: Covering temporary financial obligations, such as a mortgage, car loans, or a child's college expenses.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance. It provides lifelong coverage and is designed to last for your entire life, as long as you continue to pay the premiums.

How it works: A portion of your premium goes toward the death benefit, while the rest accumulates as a tax-deferred "cash value" component. This cash value grows at a guaranteed rate and can be borrowed against or withdrawn during your lifetime.

Best for: Leaving an inheritance, covering final expenses, or building cash value for future financial needs. It offers peace of mind with guaranteed premiums and a guaranteed death benefit.

Final Expense Insurance

Final expense insurance, also known as burial insurance, is a smaller, simplified form of whole life insurance. It is specifically designed to cover end-of-life costs, such as funeral and burial expenses, medical bills, or other small outstanding debts.

How it works: These policies have much lower death benefits (typically between $2,000 and $50,000) and are often easier to qualify for. The underwriting process is simplified, with no medical exam and only a few health questions, if any.

Best for: Individuals who want to ensure their family won't be burdened with the high costs of a funeral. It's a popular option for seniors and those with health issues who may not qualify for a traditional policy.

Guaranteed Issue Whole Life (GIWL)

Guaranteed Issue Whole Life (GIWL) is a type of final expense insurance where acceptance is guaranteed as long as you meet the age requirements (typically 50-85). It is the most accessible type of life insurance.

How it works: There are no health questions and no medical exam required. Because of this, it is considered a higher risk for the insurance company, so the premiums are typically higher, and there is a graded death benefit. This means if you pass away from natural causes within the first two or three years of the policy, your beneficiaries will only receive a refund of the premiums paid plus a small interest amount. After this waiting period, the full death benefit is paid.

Best for: Individuals with significant pre-existing health conditions who have been denied coverage elsewhere.

Choosing a life insurance plan can be complex, as each type serves a different purpose. I can help you evaluate your specific situation and goals to find a plan that provides the right level of protection for you and your family.

What is a Hospital Indemnity Plan?

A Hospital Indemnity Plan is a type of supplemental insurance that pays a fixed cash benefit directly to you (not the medical provider) if you are hospitalized for a covered illness or injury. It is not designed to replace your primary health insurance, but rather to help you cover the unexpected out-of-pocket costs that can arise from a hospital stay.

The term "indemnity" means the plan will pay a set, predetermined amount for a covered event, regardless of what your actual medical bills are. This money is paid directly to you, so you can use it for anything you need—from paying your health insurance deductible and coinsurance to covering everyday living expenses like childcare, transportation, or groceries while you are recovering.

Example

Let's imagine you have a comprehensive health insurance plan with a high deductible and coinsurance, and you unexpectedly need to be admitted to the hospital.

Without a Hospital Indemnity Plan:

• Hospital Stay: 3 days

• Total Bill: $10,000

• Your Primary Health Plan: After your insurance company pays its share, you are left with a deductible of $2,000 and 20% coinsurance on the remaining bill, which could amount to a significant out-of-pocket cost.

Your Responsibility: You are left to pay the thousands of dollars you owe out-of-pocket.

With a Hospital Indemnity Plan:

You purchase a Hospital Indemnity Plan that pays you a fixed benefit of $500 per day for each day you are hospitalized.

Hospital Stay: 3 days

Your Hospital Indemnity Plan Payout: $500/day x 3 days = $1,500 cash benefit paid directly to you.

Your Responsibility: You can use this $1,500 to help cover your primary plan's deductible and coinsurance, significantly reducing your personal financial burden. You can also use the money to pay for other costs, like taking a taxi home from the hospital or paying for groceries while you're recovering.

This is a supplemental plan that gives you financial peace of mind. I can help you determine if a Hospital Indemnity plan is a good fit for your current health coverage and overall financial situation.

How much life insurance do I need?

Determining the right amount of life insurance depends on your individual circumstances. A common guideline is to calculate the amount of money your family would need to cover future expenses without your income. Consider the following:

• Income Replacement: How many years of your income would your family need to maintain their lifestyle? A common rule of thumb is 7-10 times your annual salary.

• Outstanding Debts: Include your mortgage, car loans, credit card debt, and any other liabilities.

• Future Expenses: Account for major future costs like college tuition for children and your spouse’s retirement.

• Final Expenses: Don't forget to factor in funeral and burial costs.

What factors affect the cost of my premium?

The cost of your life insurance premium is determined by several factors, including:

Age: Your age is one of the most significant factors, as younger individuals are generally healthier and have a lower risk.

Health: Your overall health, including any pre-existing conditions, family medical history, weight, and blood pressure.

Lifestyle: Hobbies like skydiving or rock climbing can affect your rates, as can your driving record.

Gender: On average, women pay less for life insurance than men due to longer life expectancies.

Policy Type & Coverage Amount: The type of policy you choose (Term vs. Whole Life) and the amount of coverage you buy (the death benefit) are major determinants of your premium.

How does the cash value in a Whole Life policy work?

A portion of every premium you pay for a whole life insurance policy contributes to a "cash value" component. This cash value grows on a tax-deferred basis, which means you won't pay taxes on the growth as long as it remains in the policy. You can access this cash value during your lifetime by:

Taking a loan: You can borrow against the cash value, and the loan amount plus interest will be subtracted from the death benefit if not repaid.

Making a withdrawal: You can withdraw funds from the policy, which may be taxable if the amount withdrawn is more than what you have paid in premiums.

Surrendering the policy: You can cancel the policy and receive the cash surrender value.

What is a "Rider" and what are some common types?

A rider is an optional provision that you can add to your life insurance policy to provide additional benefits or coverage. They are typically added for a small extra cost. Some common riders include:

Accelerated Death Benefit Rider: Allows you to access a portion of your death benefit while you are still alive if you are diagnosed with a terminal illness.

Waiver of Premium Rider: Waives your premium payments if you become totally and permanently disabled and are unable to work.

Child Protection Rider: Provides a small amount of term life insurance for your children under your main policy.

Have More Questions?

Choosing the right plan for you and your family is a critical decision. It’s not just about finding the lowest premium; it’s about understanding what doctors and hospitals are in-network, what your out-of-pocket costs will be, and how the plan fits your lifestyle and budget. By scheduling a consultation, we can walk through your personal healthcare needs and match you with a plan that gives you the best coverage and peace of mind

Trusted Source

I partner with all major carriers to give you a wide range of unbiased options.

Personal & Supportive

My support doesn’t end with enrollment. I'll be your trusted resource for the life of your policy

Client-Focused

I'll handle the details and simplify the process so you can feel confident in your choice.

FOLLOW US

COMPANY

CUSTOMER CARE

PHONE:

725-910-8591

EMAIL:

Hours:

Monday-Friday 9:00am- 4:00pm

Saturday & Sunday By Appointment only

LEGAL

Copyright © 2012–2025 Powered by A for Insurance. All Rights Reserved

Not affiliated with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800- MEDICARE to get information on all your options. If you have any additional questions please contact us at 725-910-8591. Any redistribution or reproduction of part or all of the contents in any form is prohibited. You may not excerpt with our express written permission, distribute or or commercially exploit the contents in this site. Medicare has neither reviewed nor endorsed this information.